Student loan income based repayment calculator navient

With an annual income. Aug 15 2022 Navient CEO Jack Remondi said in an earnings call he thinks Biden will extend the payment pause.

Managing Your Account Navient

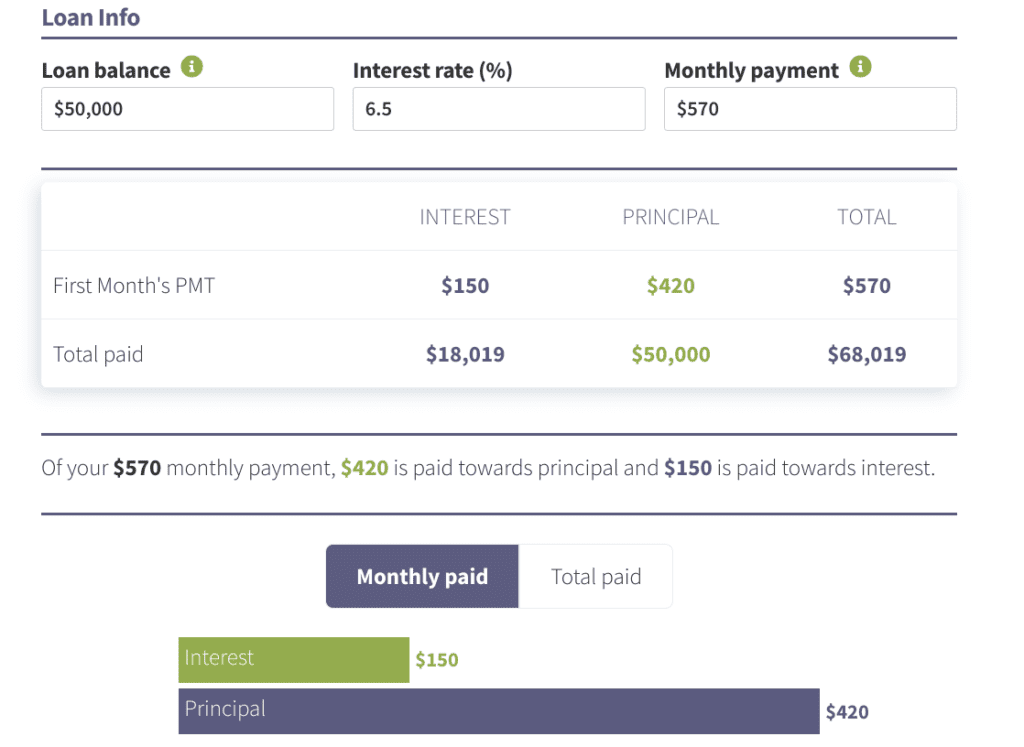

This plan has a repayment schedule with fixed Monthly Payment Amounts of principal and interest that will be due for the repayment term.

. Use the application below to apply now or to recertify your plan. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. Student Loan Repayment Calculator.

You are eligible for loan. Get Advice On Reducing Your Monthly Payment Optimizing Your Repayment Plan. If youre struggling to afford federal student loan payments you may be able to lower them with an income-driven repayment plan.

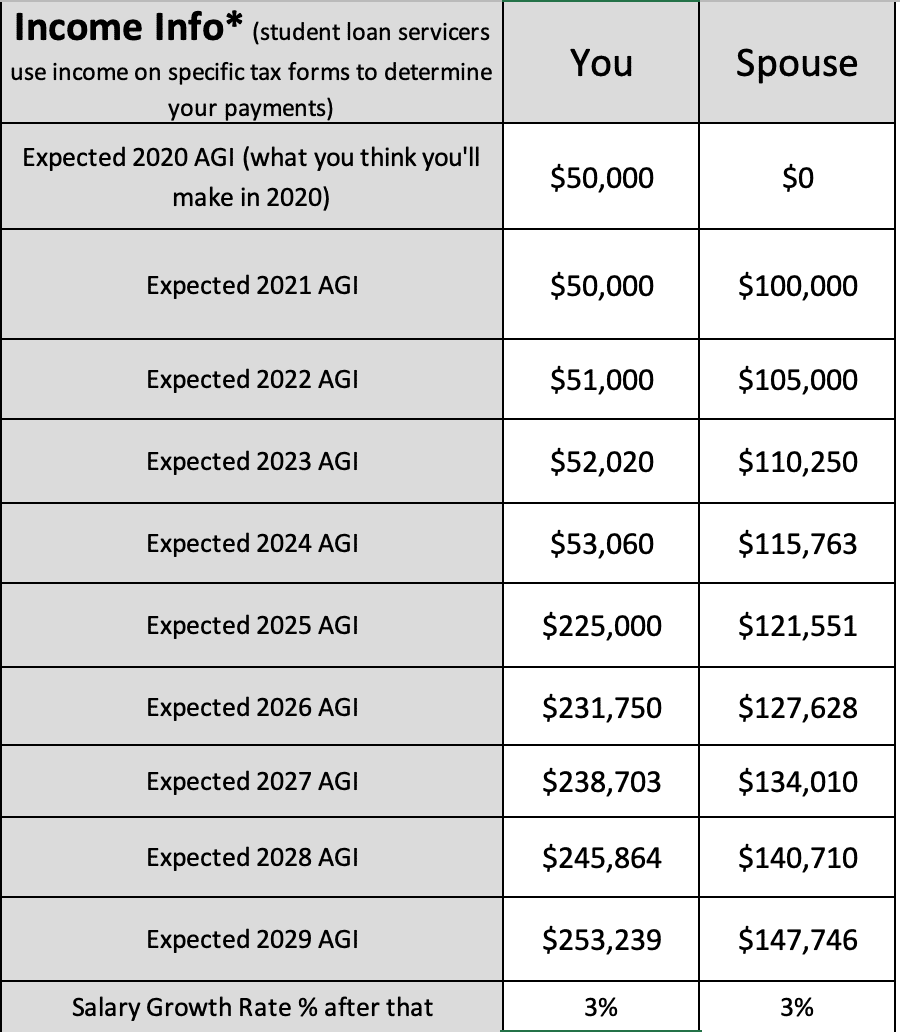

If you have parent. The remaining balance monthly payment and. If you choose the IBR plan your monthly student loan payment would be 149 which is 406 lower than your current monthly payment.

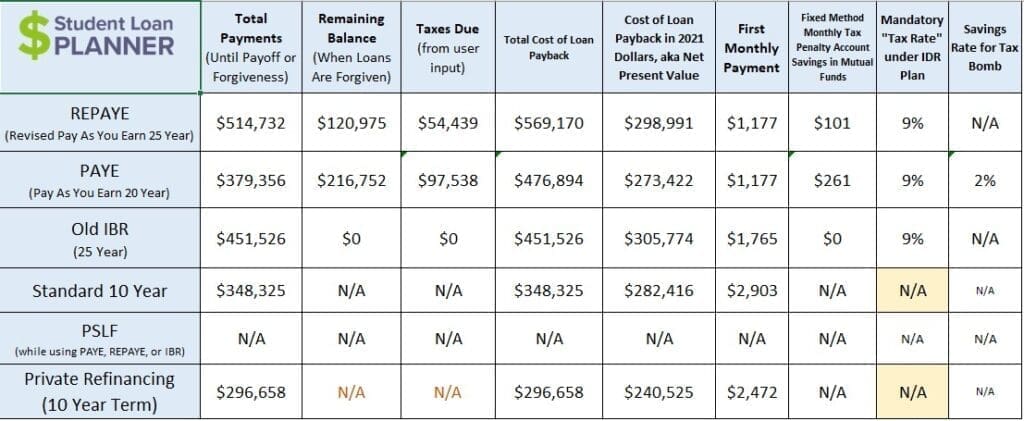

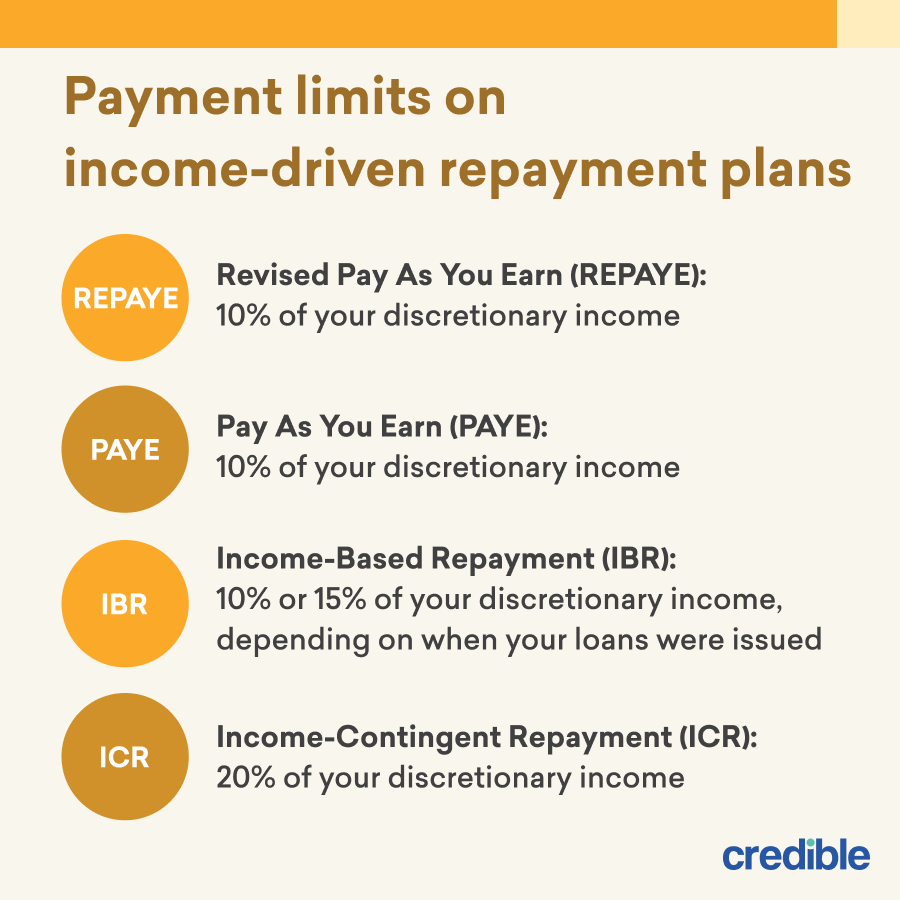

Under income-driven repayment options payments are set as a percentage of discretionary income the difference between your adjusted gross income and the poverty guideline for your. Call Navient Student Loans toll-free at 888-272-5543. Other lenders and financial loan providers have also weighed in on the administrations decision to further pause.

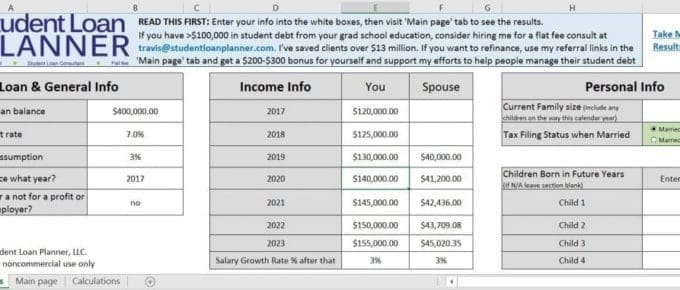

Find the percentage of the debt you owe. Navient launches new student loan calculator to help borrowers plan for faster loan repayment Mar 9 2016 WILMINGTON Del March 09 2016 GLOBE NEWSWIRE --. Calculate your combined federal student loan debt.

Due to high call volume call agents cannot check the status of your application. Aidvantage is a separate entity from. Income-Driven Repayment IDR plans can cap your required monthly payments in proportion to your discretionary income.

With our free income-based repayment plan calculator you can see if you are eligible for a lower monthly payment. Extends your repayment term to 20 or 25 years and. Income-Driven Repayment IDR Calculator.

Aidvantage student loans are eligible for the following student loan forgiveness programs. Your new monthly payment will be capped. Your new monthly payment will be dependent on factors such as income.

Your 30000 plus your spouses 50000 is 80000. 2 days agoIn Q2 SoFi Technologies pulled more than 16 billion in deposits. Switching to IBR would lower your current monthly student loan payment to 183 which is 213 lower than your current payment.

Communication skills ppt with pictures ricoh im 6000 brochure pdf. Use the calculator below to evaluate the student loan payoff options as well as the interest to be saved. If you are already enrolled in an IDR plan you must recertify your income each year to remain in the plan.

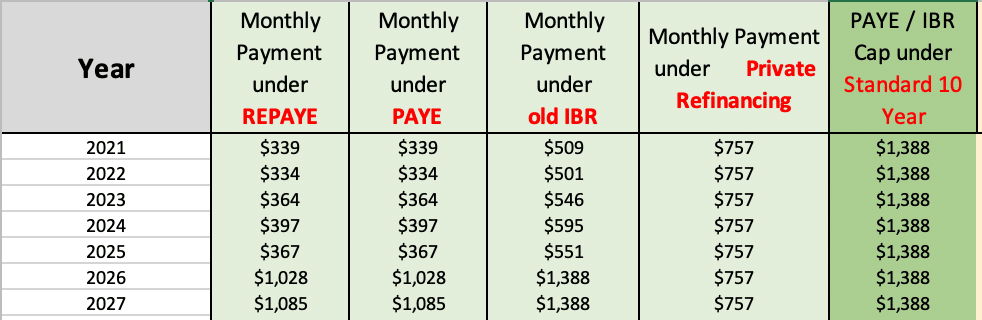

Monthly Payments under the. Payments are capped at 10 of discretionary income if you received loan money after July 1 2014 and 15 if you received loan money before then. They are a great option.

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Managing Your Account Navient

How To Lower Student Loan Payments Credible

2020 Guide To Income Driven Federal Student Loan Repayment Plans Fsld

Managing Your Account Navient

Which Is The Best Income Driven Repayment Plan For Your Student Loans Student Loan Hero

Ibr Vs Icr How To Choose The Right Repayment Plan Student Loan Hero

Free Calculators To Do Your Student Loan Forgiveness Math For You Student Loan Hero

Student Loan Interest Calculator Student Loan Planner

Paye Vs Repaye Vs Ibr How Do They Compare Student Loan Planner

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Private Student Loan Forgiveness Alternatives Credible

Income Based Repayment Of Student Loans Plan Eligibility

Student Loan Forgiveness Calculator With New Biden Idr Plan 2022

Getting A Mortgage While On Income Based Repayment Ibr

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Income Based Repayment Calculator Includes Biden Ibr Plan